America's Return to Strong Growth

The Fed Sees the US Economy Growing at an Increasingly Robust Pace, Beating Past Projections

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 36,000 people who read Apricitas weekly!

Yesterday, amidst an otherwise uneventful meeting of the Federal Reserve’s rate-setting committee, Jerome Powell once again upgraded his assessment of US economic growth—activity is now seen as expanding at a “strong” pace, completing the crescendo of growing optimism that began as the Fed went from describing growth as “modest” to “moderate” to “solid” over the course of the prior 3 meetings. That optimism is a reflection of the extremely high Q3 GDP print released last week—America’s real output grew at a 4.9% annualized rate, the fastest pace since the beginning of the Fed’s tightening cycle in early 2022, driven by rising household consumption, significant inventory buildups, and a steady recovery in government output.

This has brought cumulative real GDP growth over the last year to 2.9%, continuing to bounce back from its 2022 lows and returning to levels more in line with the high growth years of the 2010s. In fact, these numbers are so strong that GDP could shrink by 0.8% annualized in Q4 and still match the median FOMC participants’ growth projections from last month. Year-on-year growth in nominal, non-inflation-adjusted, economic output picked up again to 6.3%, but even still the inflation gap between real and nominal GDP growth shrank to the smallest level since early 2021.

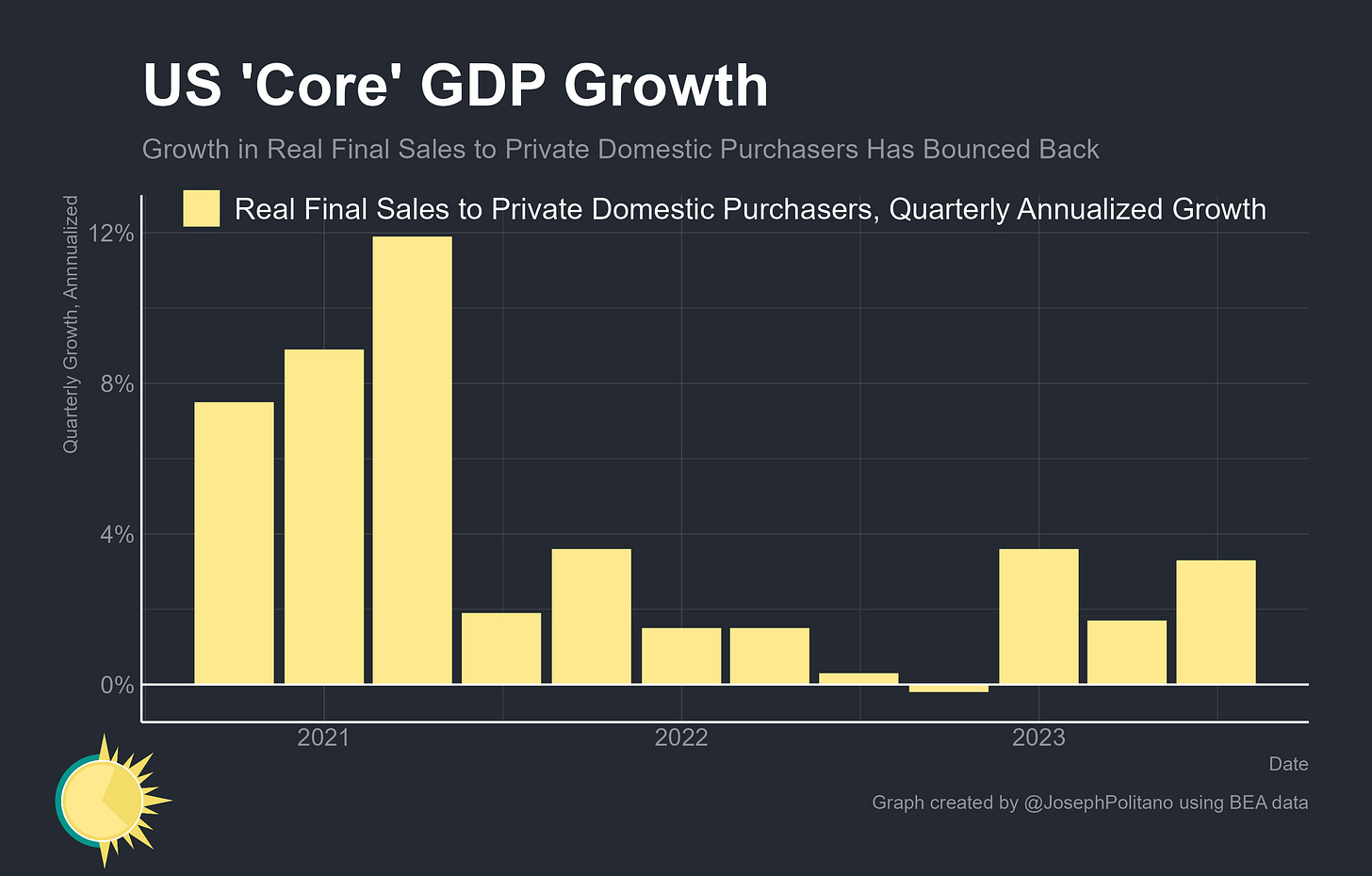

The picture is slightly weaker but still strong when looking at “core” real GDP growth—real final sales to private domestic purchasers—a measure equivalent to private consumption plus private fixed investment that very rarely turns negative outside recessions. That metric grew at a 3.3% annualized rate in Q3, more than double the strongest quarters of 2022, and brought year-over-year growth back to a respectable 2.1%.

Meanwhile, high wage growth in the comprehensive Employment Cost Index (ECI) data released this week suggests that nominal gross labor income—the aggregate sum of wages and salaries in the economy and a key driver of cyclical economic dynamics—was stronger than previously thought. In other words, demand-side nominal growth, while decelerating, still remains above normal levels. That, combined with the continued easing of supply-side constraints across the economy, is allowing the US to once again experience strong real economic growth