Can Australia Keep the Miracle Going?

Australia Dodged the 2008 Recession and Has Achieved One of the Strongest Post-COVID Recoveries. But Can They Avoid Looming Recession Risks Again?

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 23,000 people who read Apricitas weekly!

Otherwise, liking or sharing is the best way to support my work. Thank you!

Australia’s 21st-century economic record is one of the strongest in the world—especially when compared to the slowdown and stagnation in other high-income nations. Before the COVID-19 pandemic, it had not experienced a recession since 1990, shaking off the Global Financial Crisis with an economic slowdown that still avoided an official downturn. As the Chinese economy grew, Australia enjoyed a significant boom in industrial and commodity exports—thanks to its large market share in coal, iron ore, gold, aluminum, natural gas, lithium, and more. Its extremely high net immigration levels—30% of Australian residents are foreign-born, double the share in America—has given the country one of the most dynamic labor markets in the world. In fact, if the American economy had grown at the rate of the Australian economy from 1992 to the end of 2019, it would have been nearly 20% larger.

Australia’s recovery from the pandemic has been stronger, too. Strict lockdowns, intense COVID restrictions, and the relative isolation afforded by being an island nation meant Australia was hit much less intensely by the public health effects of COVID-19—data analysis from The Economist suggests that the cumulative rate of pandemic-era excess deaths in Australia is about 1/4 what it is in the US. Prime-age employment levels rose more than 2%, pulling even further ahead of America’s and setting new record highs. Plus, a rebound in global commodity prices amidst inflationary pressure was a boon for the nation’s exports, with the trade surplus notching a record high in June. As real growth in the US stumbled last year, it remained strong in Australia, and Australian net immigration started recovering throughout 2022 as international travel restrictions were eased.

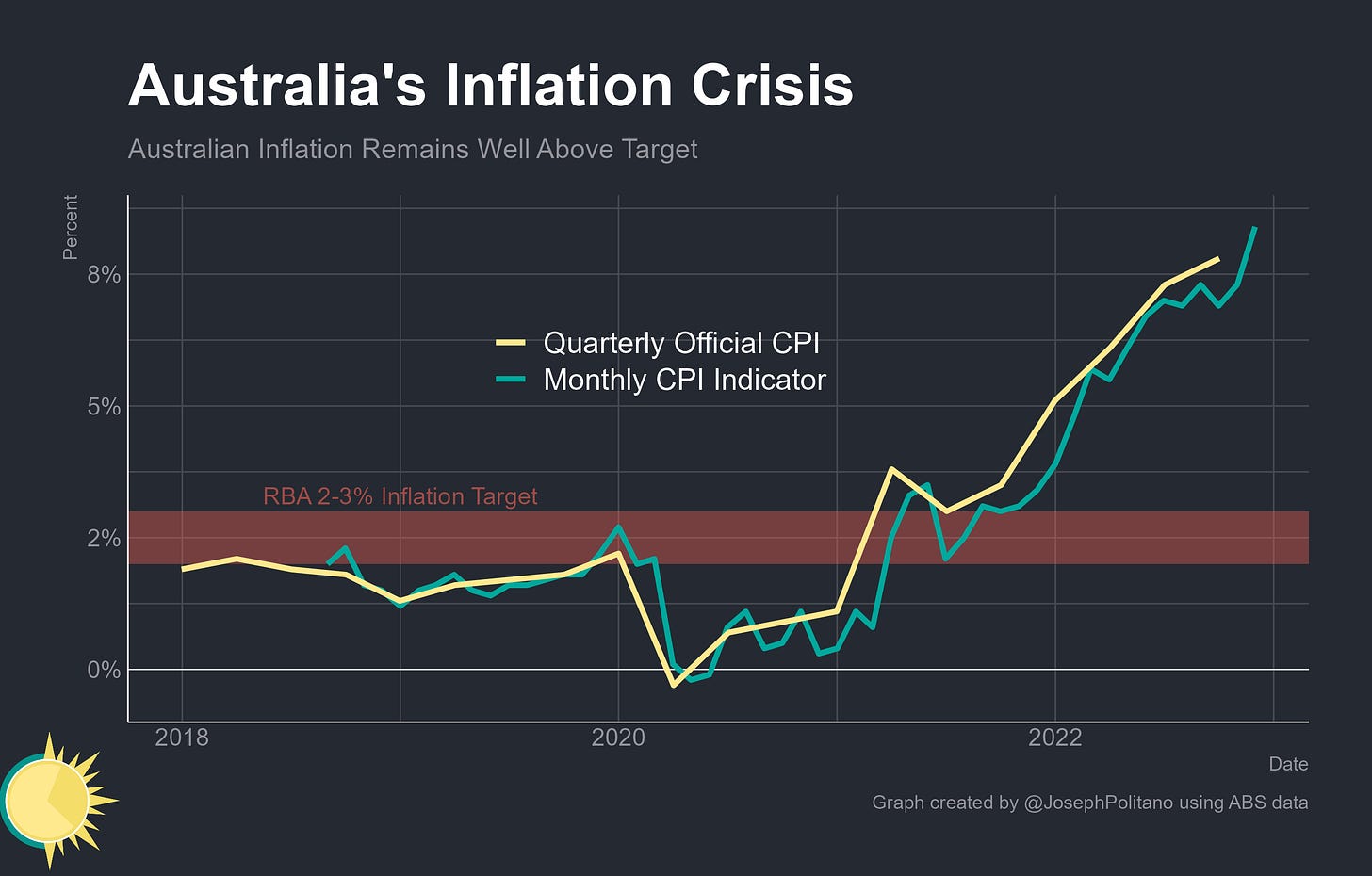

Yet the Reserve Bank of Australia (RBA) finds itself in much the same predicament as many central banks across the globe. Official inflation sits at an eye-watering 7.8%, with the more-frequent monthly inflation indicator at 8.4%—both a far, far cry from the RBA’s 2-3% target. Some pain is expected to be necessary to bring inflation back down—the central bank’s forecasts are for the unemployment rate to increase for the next two-and-a-half years and for GDP growth to slow for the next one-and-a-half years—and RBA Governor Philip Lowe recently said that “the path to achieving a soft landing remains a narrow one.” But Australia is hoping it can keep its miracle going—and that the factors that made its economy uniquely strong throughout the 21st century might spare it from recession again.