Stabilizing an Unstable Coin

Stablecoins are Increasingly Important Parts of Global Currency Markets, and May Pose Risks to the Global Financial System.

The views expressed in this blog are entirely my own and do not necessarily represent the views of the Bureau of Labor Statistics or the United States Government.

Thanks for reading. If you haven’t subscribed, please click the button below:

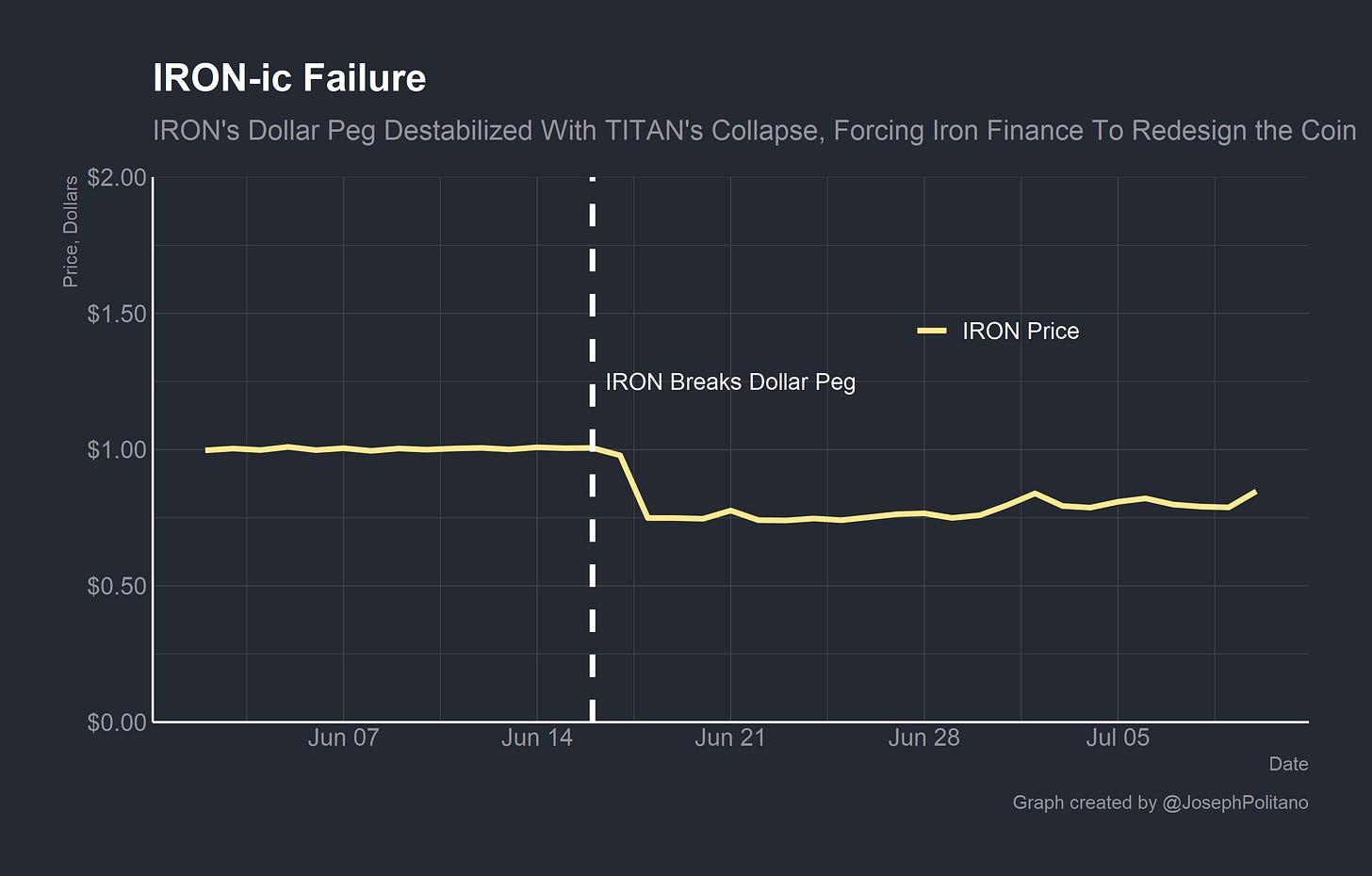

On June 17th, the cryptocurrency TITAN began sliding from its peak value of $62. Within the span of a single day, the coin would tank all the way to virtual worthlessness. TITAN was part of Iron Finance’s decentralized finance (DeFi) ecosystem and composed part of the collateral for the stablecoin IRON, a coin designed to always maintain a value of $1. As TITAN’s price declined, IRON lost its dollar peg and the currencies’ automatic protocol failed to stabilize the value of IRON. This lead to a digital bankrun that vaporized TITAN and permanently knocked IRON below $1 in value. For a so-called stablecoin, IRON proved to be anything but stable.

Stablecoins are special kind of cyptocurrency where prices are directly pegged to more stable assets, usually the dollar. Centralized stablecoins maintain this peg through the use of reserves — essentially, you give the stablecoin company $1 and they give you 1 stablecoin, and you can go back to the company at any point to redeem your 1 stablecoin for $1. There is an extremely critical difference between traditional decentralized cryptocurries and stablecoins: at the base level, stablecoins must be ran by a centralized entity in order to manage dollar or other assets in the traditional financial system. While there are decentralized stablecoins like IRON, theses function primarily by holding centralized stablecoins, at least in part.

Stablecoins have dramatically increased in market capitalization and volume over the last two years, with the market leader Tether alone minting more than $60B worth of coins. These currencies facilitate smooth dollar-denominated transactions within crypto networks without requiring the use of clunkier, heavier regulated, and more restrictive traditional financial institutions. As a result, stablecoins have rapidly integrated the crypto ecosystem into the dollar system while enabling smooth transactions, greater accessibility, and greater global interconnectivity than the traditional financial system. However, the digital dollar printers have operated on the edges of legality, without the regulations and supervision that make traditional dollar banking safe and secure. Like in much of the crypto world, scams and failures abound in the stablecoin space. For digital dollar currencies to work, they must be integrated into the traditional global dollar network, fully backed by cash and risk free bonds, and scrutinized heavily by consumers and users.

The Digital Dollar

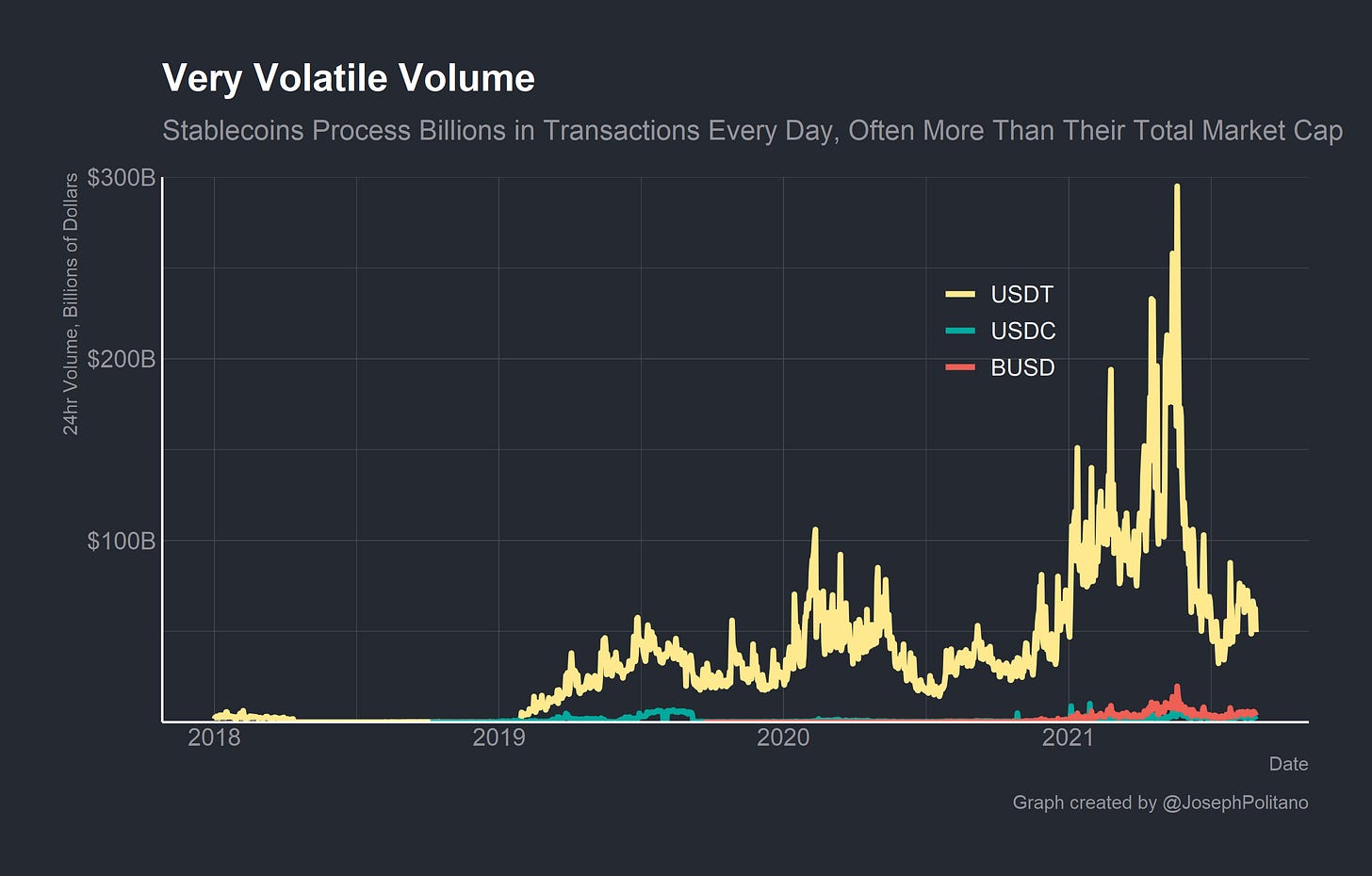

Tether (USDT) is the world’s largest stablecoin, with coinbase’s USD Coin (USDC) and Binance USD (BUSD) lagging behind. The total market capitalization, meaning the total value outstanding, of dollar stablecoins now easily exceeds $100 billion. While this is nothing compared to the more than in $20 trillion total money stock, it is a rapidly growing part of the global dollar ecosystem. Before 2020, the total value of the stablecoin market barely inched across the $5 billion mark, meaning the market has grown a staggering 2,200% in under two years.

The promise of digital currencies is incredible and limitless: smart contracts, new protocols, and programmable currencies are all substantial innovations that are simply impossible in the current formal financial system. More than that, stablecoins have opened dollar-denominated markets to unbanked and underbanked people across the world who may have no other way to access US dollars. It is no wonder that these coins have seen incredible growth given their extreme usefulness and the rising value of the crypto market.

Partly as a result of their myriad uses, stablecoins, especially Tether, have extremely high trading volumes. These coins have extremely high “money velocities”, the rate at which a given dollar is exchanged in the economy, in contrast to the low and decreasing velocities in the traditional financial system. This velocity is mostly high due to trading volumes on cryptocurrency exchanges, not direct purchases of goods and services in the economy, but these high volumes amplify the risk of any given stablecoin. Most transactions are simply exchanges of stablecoins for non-stable crypto assets like bitcoin or Ethereum, but the large daily volume raises the possibility of large redemptions at any given point. What would happen if one of these stablecoins broke its dollar peg and ceased to be stable any more?

TITAN-ic Failure

Two months ago, the TITAN coin and it’s associated algorithmic partially collateralized stablecoin IRON collapsed in what Iron Finance called “the world’s first large-scale crypto bank run.” TITAN was a free-floating decentralized cryptocurrency that was paired with IRON, a stablecoin, as part of Iron Finance’s decentralized DeFi ecosystem. Essentially, IRON would be partially backed by USDC and partially backed by TITAN while automated protocols would ensure that the price of IRON would always remain at $1 even as TITAN’s price floated. TITAN offered yield farmers (people who deposited crypocurrency in an automated lending protocol) interest rates in the billions of percent.

What Iron Finance hadn’t accounted for, however, was the complete and total collapse of the TITAN coin. Essentially, a few large holders began to sell their TITAN coins on July 16th. The resulting decrease in price knocked IRON below it’s $1 peg, as IRON is partly collateralized with TITAN. Traders could then use the algorithmically driven protocol to redeem IRON for $1 worth of USDC and newly minted TITAN coins. So far, everything is working as intended. The critical failure point was in the smart contract, an automated transaction protocol that was supposed to maintain the peg.

The protocol used a 10-minute time weighted average price to determine the percent of TITAN and USDC that IRON could be redeemed for. As the price tanked rapidly, the smart contract was behind the curve - essentially providing redeemers with too much TITAN and not enough USDC. Traders could buy IRON for $0.90 and exchange it for $0.75 in USDC $0.25 in newly minted TITAN, because the protocol could not keep up with price shifts and stabilize IRON. With every redemption, newly minted TITAN would be sold onto the market by traders, pushing the price down further. The flood of newly minted TITAN, more than 30 trillion tokens in total, made TITAN practically worthless and destroyed the value of IRON’s TITAN collateral, breaking it off the peg completely. It is a testament to how quick and volatile cypto markets are that the price could diverge so much within a ten minute timeframe to cause this issue.

After breaking the peg, IRON holders were only able to recoup approximately 3/4 of their initial investment. The total value of the TITAN coins that backed IRON had declined practically to zero, leaving only the USDC to compensate IRON holders with. IRON and TITAN’s rapid collapse in the face of a large scale crypto bank run exposes the inherent and unique risks of a partially collateralized stablecoin.

Iron Finance claimed that the IRON stablecoin was analogous to a traditional fractional reserve bank, where a private bank can create money but must keep a certain percentage in reserve for the amount of loans outstanding. This is not how banks work in the modern economy, as today’s banks create money through the process of lending and seek out reserves only to make payments between banks. Nor is it a particularly apt comparison to banks during the gold standard period or earlier, as those banks interacted in a broader system with a central bank often acting as a lender of last resort. However, just as in the era before the Federal Deposit Insurance Corporation (FDIC) backed most bank deposits and the Federal Reserve acted as a lender of last resort to American banks, stablecoins rely heavily on consumer trust and will break if their users’ lose faith in them.

In the modern United States, it is practically impossible for traditional bank runs to occur. Depositors know that the FDIC will compensate them as long as their bank balance was below $250,000, and banks know that the Federal Reserve will ensure liquidity in the interbank market by acting as a lender of last resort. In the DeFi ecosystem and the crypto world, there is by definition no centralized authority to ensure the stability of stablecoins or back them in times of crisis. It is not possible for a decentralized stablecoin to be risklessly pegged to the dollar or any other currency: as long as the stablecoin is partly backed by a decentralized coin, it is reliant on users’ trust. This is not as bad as it initially seems: gold, bitcoin, and dollars are all in a “bootstrap equilibrium” where they have no inherent value but derive their value solely from social acceptance and trust. It just means that in a fast moving market where volatility itself is often the main draw, it is extremely difficult to sustain a dollar peg without dollar assets for any period of time—and it is impossible for any stablecoin to guarantee a dollar value without 1:1 backing in risk-free dollar assets. However, even the centralized stablecoins carry significant risks, and the risks posed by the failure of a centralized stablecoin are orders of magnitude larger than that of a decentralized stablecoin.

UnTethered and Unchained

Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines. Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie. These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.

New York Attorney General Letitia James, February 23rd 2021

Tether is double the size of the second largest stablecoin, and on its own composes a majority of the stablecoin market. It has processed hundreds of billions of dollars in volume at peak, and plays a critical role in supporting the crypto ecosystem. Cryptocurrency traders use Tether constantly to enter and exit dollar-denominated trades or within DeFi protocols. Tether, however, has serious legal and financial risks that present challenges for the entire crypto and broader financial systems.

First, legal; Tether has allegedly had points when it was not fully-backed by dollars or other financial assets in its reserves. The New York Attorney General’s (NYAG) investigation claims that Tether, by mid-2017, had no access to banking and therefore let its reserves go partially unbacked for large periods of time. The report further alleges that Tether fraudulently created two reserve verifications by depositing money in a bank the day before the attestation and removing the money the day after. To public knowledge, Tether has never been fully audited and broke off its relationship with Friedman LLP mid-audit with the statement below:

We confirm that the relationship with Friedman is dissolved. Given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of Tether, it became clear that an audit would be unattainable in a reasonable time frame.

Tether Spokesperson, January 27th 2018

To be clear, Tether claims that the reason an offshore financial institution cannot be properly audited is because it would be too “excruciating detailed” and “unattainable in a reasonable time frame.” While Tether has never broken its dollar peg before, there is no guarantee that users would have legal recourse against Tether or its parent company if Tether ever did break the dollar peg. Unlike with regulated depository financial institutions within the banking system, the Federal Deposit Insurance Corporation will not compensate American Tether users in the event Tether collapses.

The leaking of the Paradise Papers also allegedly revealed that the owners of Tether were the same people who owned Bitfinex, a large cryptocurrency exchange. This allegation was corroborated by the NYAG’s investigation, which also flatly accused Tether of using its reserves in order to cover shortfalls in Bitfinex’s balance sheets caused by other banking issues. Tether even now admits that its reserves include “loans made by Tether to third parties, which may include affiliated entities.” A great breakdown from YouTuber Coffeezilla goes into more detail on all the alleged impropriates of Tether, Bitfinex, and their owners. As a result of these perceived improprieties Tether and Bitfinex are banned from trading in New York, the financial capital of the world, and countries like Canada have stopped brokers from offering Tether altogether. The bottom line is that Tether is able to evade the rules and regulations that protect consumers and users in the traditional financial system, dramatically increasing the risk of Tethers compared to bank deposits.

Second, financial; there are significant risks to Tether’s reserves even outside the legal issues. Tether is extremely invested in commercial paper, unsecured short-term debt usually from extremely trustworthy corporations, alongside corporate bonds and secured loans. It is worth noting that these reserve breakdowns are explicitly a result of the NYAG’s investigation and were previously not available. Although it has been moving into bank deposits and treasury bills, short-term risk-free US government debt, their portfolio remains too risky given the needs to back Tether. While traditional banks are able to diversify across mortgages, consumer debt, corporate and business loans, and so on, Tether is much closer to a money market fund than a traditional financial institution.

Essentially, traditional banks are well capitalized institutions that rely on interbank lending and borrowing to ensure they are always liquid. If any bank were to run into desperate straits, they can borrow newly printed money directly from the discount window at the Federal Reserve. Tether has extremely low capitalization—by their own admission they currently have only 0.2% more assets than liabilities—and and extremely high risk of depositors fleeing. Given the rapid volume flows in the cryptocurrency space, the idea of Tether holders requesting billions of dollars in dollar redemptions in a short period of time is not unfathomable. Given the low capitalization and large risks Tether has by virtue of existing outside the traditional financial system, the amount of commercial paper Tether is holding is frankly too high and the amount of cash and T-bills far too low.

USDC, the second largest stablecoin, has basically acknowledged this reality. They announced that their currency would be fully backed by cash and Treasury securities as of September. This is the core choice faced by all stablecoins. Either they have to be 1:1 backed with traditional bank deposits and Treasuries backed by the Federal Reserve or regulations would have to change to have them direcly backed 1:1 by the Federal Reserve itself. With even the slightest amount of stablecoin reserves in risky assets like commercial paper, corporate bonds, or long-dated Treasuries, stablecoins risk a crisis of faith, bank run, or other financial turmoil permanently knocking them off their dollar peg.

Tether has never had to deal with large redemptions, as their balance sheet has continually grown virtually since its inception. If they ever did have to deal with significant redemptions during a period of financial turmoil, they may not be able to fully compensate Tether holders. This would, to put it lightly, be catastrophic for the crypto industry and possibly the wider financial system. Given the sheer amount of cyptocurrency wallets that hold Tether and the large numbers of exchanges and protocols that use Tether, it is hard to imagine any area of the crypto ecosystem escaping unscather. A crisis of faith in Tether would have knock on effects on other stablecoins, DeFi ecosystems, and cryptocurrencies, possibly leading to a flight to bank deposits that sucks value out of the crypto market.

To be clear, I am not suggesting that Tether will break the dollar peg anytime soon, or even at all. It is in the vested interest of Tether and many institutions in the crypto ecosystem to prevent the collapse of the stablecoin by any means necessary, and in all likelihood the assets Tether has will be sufficient for normal redemptions and market turbulence. My only point is that the current makeup of Tether’s reserves leaves it vulnerable to the possibility of collapse, and even that small possibility is a risk the cypto and financial community should not accept.

Conclusions

To move forward, institutions in the crypto community ought to acknowledge the inherent risks of partially collateralized stablecoin. The SEC ought to gain regulatory authority over the centralized aspects of the crypto market, including stablecoins, and institute requirements for stablecoins to be issued to consumers. The Federal Reserve should offer stablecoins the same access to the discount window that banks get and the same access to repo facilities that money market funds get. Critically, the Federal Reserve must back stablecoins in the same ways it backs all dollar-denominated markets while not making stablecoins effectively risk-free digital dollars. If the Federal Reserve were to fully back digital currencies, users with assets exceeding FDIC insurance would move from banks to digital currencies in the event of a crisis, raising the possibility of panics and crashes in the traditional financial system.

The promise of stablecoins, however, is not something that should be ignored. They are the closest thing to a central bank digital currency that currently exists, and are a revolutionary step up from traditional payment networks. The mere idea of a programmable dollar is a wellspring of pure potential. Nor could the SEC or Federal Reserve even eliminate the stablecoin market if they tried; pushing institutions like Tether out of the traditional financial system and into the shadier fringes only increases the risks to consumers and prevents the financial world from reaping the benefits of a fully integrated digital payments network. Instead, the Federal Reserve and regulatory institutions should embrace the digital dollar and work to ensure that it is as stable and safe as possible.