The US Added 210,000 Jobs In November: Here are the Challenges Still Facing the Labor Market

The labor market is strengthening, but COVID and other structural changes are affecting employment.

The views expressed in this blog are entirely my own and do not necessarily represent the views of the Bureau of Labor Statistics or the United States Government.

The labor market improved significantly in November as the US added 210,000 jobs and the unemployment rate declined to 4.2%. Seasonal adjustments brought the headline number down significantly, as non-seasonally adjusted payrolls increased by 778,000 in November. America is still millions of jobs short of pre-pandemic employment levels, but the pace of improvement remains strong despite the complications introduced by the delta and omicron variants. Public perception of the labor market recently hit its highest level since data collection began!

In The Aggregate

The prime age employment-population ratio, which tracks the percent of working age adults with jobs, jumped up to 78.8%. American employment rates suffered tremendously at the onset of the pandemic, especially when compared to peer nations like Japan, Germany, and the United Kingdom. These nations focused on various job and payroll support schemes that kept workers attached to their jobs despite the pandemic. The US system focused more heavily on direct aid to households (stimulus checks), expanded unemployment insurance, and a smaller version of payroll support in the form of the Paycheck Protection Program (PPP).

America simply did not have the infrastructure at the federal level to implement the kind of payroll subsidization programs that would have prevented firings in the first place. Keep in mind that the CARES Act was passed on March 27th—after millions of workers were already out of a job. Also keep in mind that America did a rather poor job of containing the pandemic. Japan and Australia both saw comparatively smaller drops in employment at the onset of the pandemic and have already presided over a full labor market recovery. Getting back to pre-pandemic employment levels will require time—though there is no strict “speed limit” to aggregate employment growth it is true that companies can only onboard so many people at once.

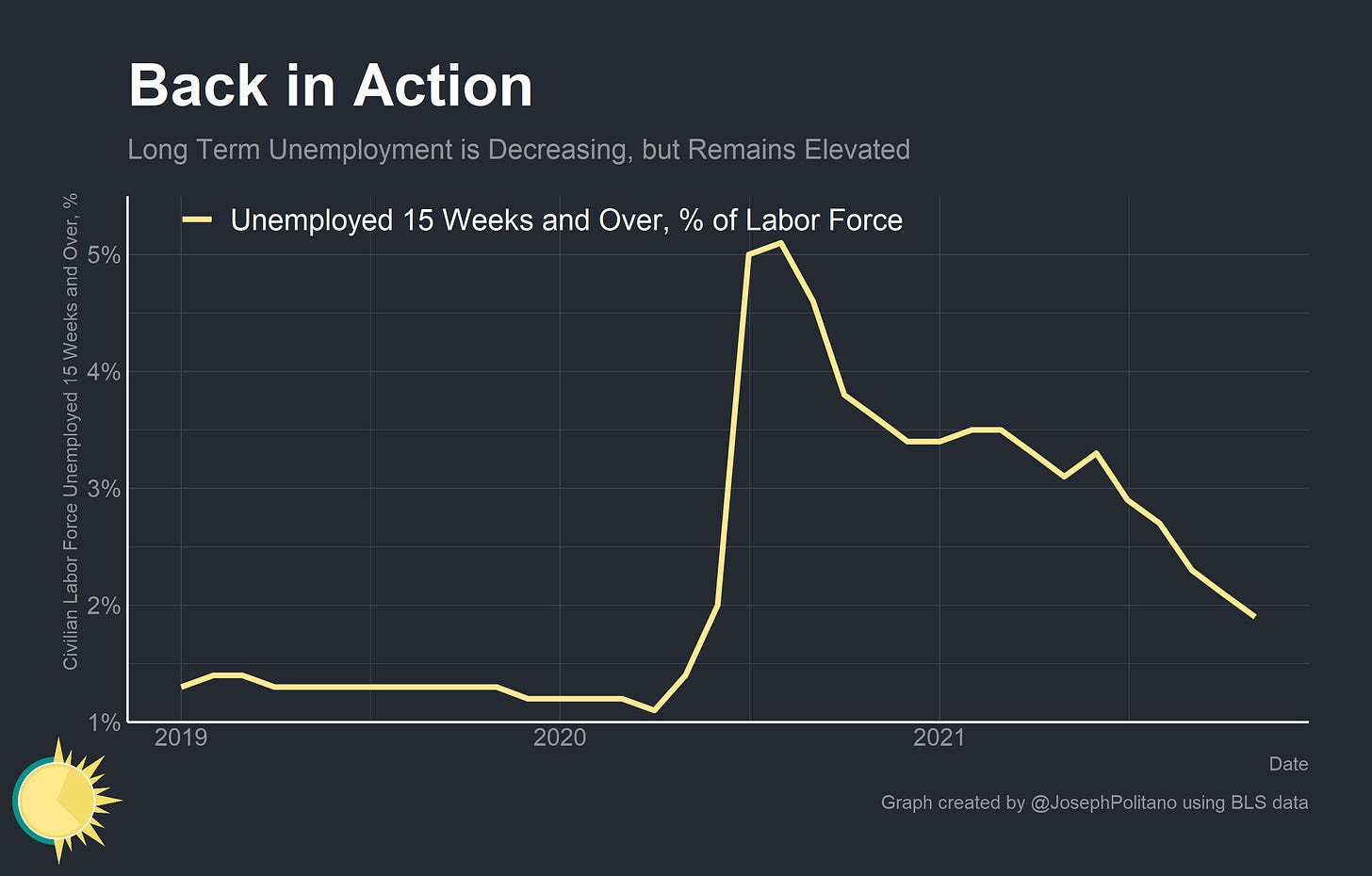

The good news is that the number of long-term unemployed, exactly the kind of workers that are hardest to onboard, is decreasing. Long term unemployment dipped to 1.9% in November after several straight months of decline. This still leaves long term unemployment above the pre-pandemic level, but sustained improvements in labor market conditions (and the ending of some barriers to work stemming from increased childcare and family care responsibilities) should bring long term unemployment down.

In the Weeds

Employment in the leisure and hospitality sector grew by 23,000 in November, which is not a sizeable improvement for a sector that is still far below pre-pandemic employment levels. Diving deeper into the sector’s data helps illustrate why.

Take food service as an example. At the onset of the pandemic, more than 12 million employees worked at food service and drinking establishments and these establishments brought in $66 Billion in sales per month. When the pandemic hit sales sank and firms laid off almost 1/2 of all workers. Today, spending has more than completely recovered—but employment remains about 700 thousand jobs below pre-pandemic levels. Why is this?

Firms are likely doing more with less—the increase in remote work and virus fears likely pushed more consumers to opt for take out or delivery instead of dining at the restaurant itself.

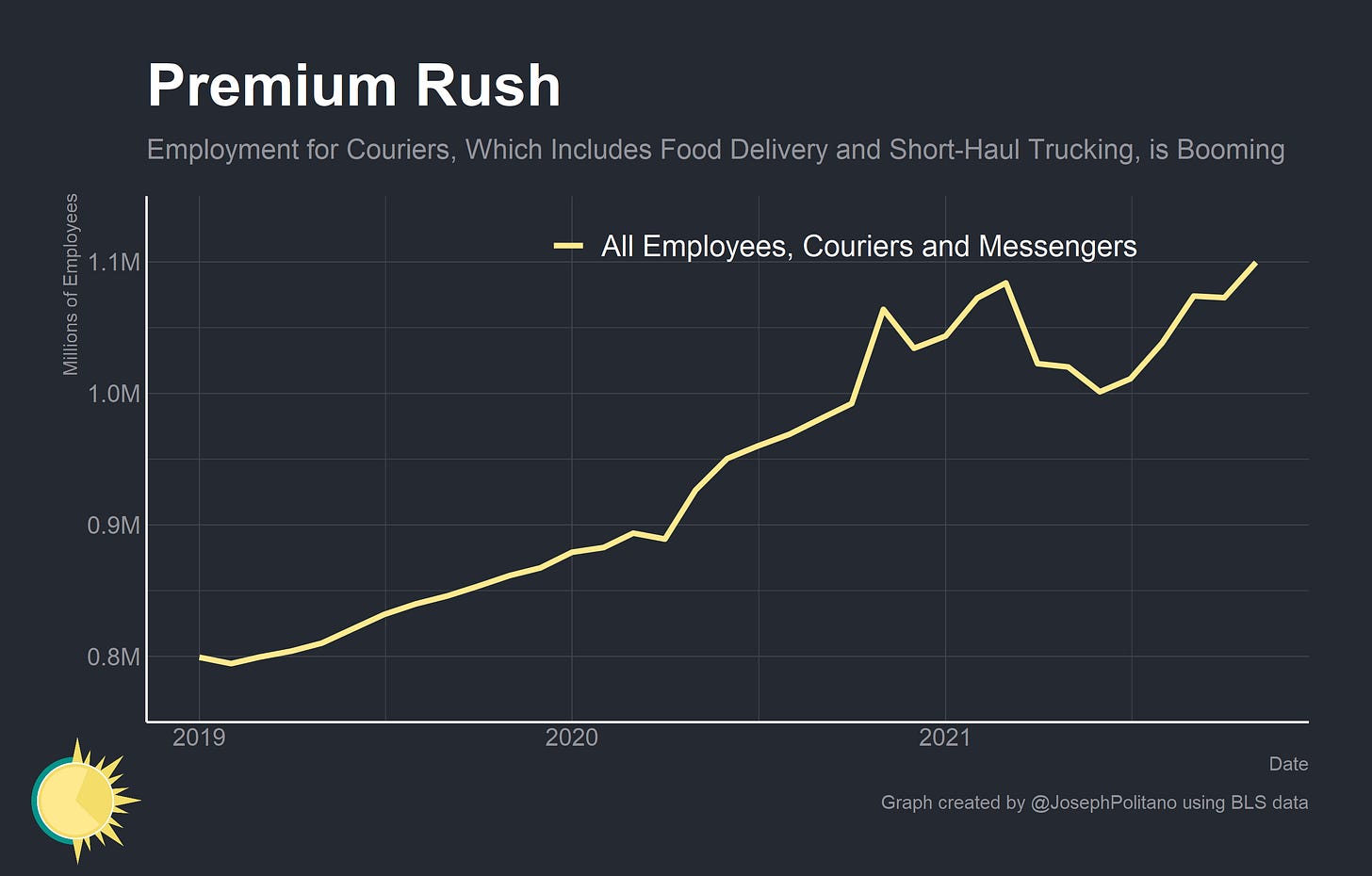

Indeed, there has been a boom in employment for couriers and messengers (a wide group that has evolved to include everything from short haul trucking to food and grocery delivery). It is here where it becomes hard to draw exact conclusions about employment in food delivery, though. Uber, Instacart, DoorDash, and other food delivery apps classify their workers as contractors, not employees, so their employment is not captured in the chart above. Since these workers are technically self-employed, they are not actually captured anywhere in the establishment survey. The household survey does show a jump in unincorporated self-employment post pandemic, but it is hard to tell how much of this is food delivery. It will take additional data to grasp whether the transition to takeout remains permanent and how many workers are now employed in food delivery. More than that, we should not necessarily expect continually increases in food service employment. During tight labor markets wait staff and other restaurant employees tend to quit for higher paying, more promising jobs. Restaurants are contending with rising wages by boosting productivity, and that means fewer but higher-paid employees for the same level of sales.

Although the accommodation industry (hotels, motels, etc.) is showing a similar pattern of recovered spending without a recovery in employment, the arts and entertainment industry tells a different story. Spending is still down 15% from pre-pandemic levels, and employment is suffering to a similar degree. People are simply attending sports games, fitness classes, and gambling tables less than they were pre-pandemic, and it will take time for spending to recover in these areas. It should also be noted that the drop in foreign arrivals (mostly tourists) is not doing the entertainment industry any favors.

One area where Americans are spending money—and a lot of it—is consumer and durable goods. Spending on durable goods is about 30% higher than it was pre-pandemic, and spending on nondurable goods is about 10% higher. The result has been an unprecedented boom in employment in the transportation and warehousing industry. As of November, 6 million workers were employed in the sector, a jump of approximately 10% from pre-pandemic levels. It will be worth keeping an eye on the sector as the pandemic abates—the sheer volume of goods spending has kept employment growth high even as Americans are ordering a smaller share of goods through e-commerce sites when compared to the early pandemic.

On a more somber note, employment at nursing care facilities has been sliding significantly since the start of the pandemic. The drop in nursing care employment makes up nearly half of the missing jobs in the entire healthcare sector. The reason for this is extremely morbid: the Centers for Medicare and Medicaid Services estimate that approximately 10% of nursing home residents passed away from COVID-19. Prospective residents likely also attempted to find other, COVID-safe arrangements instead of joining a nursing care facility, further dropping demand.

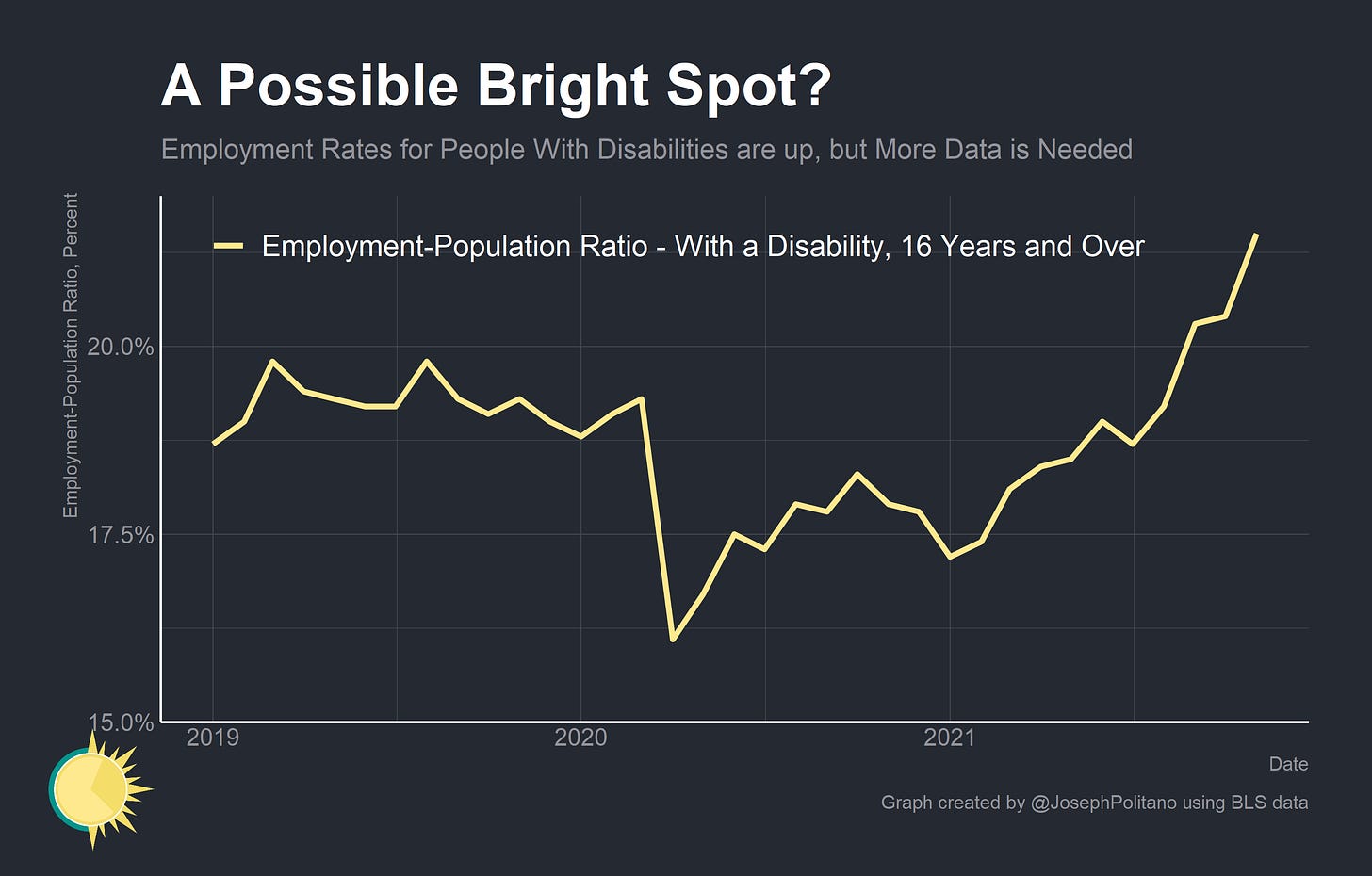

One possible bright side of the pandemic is the increased accessibility of employment thanks to the adoption of remote work, videoconferencing, and other technological progress. The employment-population ratio of people with disabilities has crossed pre-pandemic levels this year and continues to climb. Though forcing those for whom work is extremely difficult into jobs is not a good thing, it is always worth remembering that there is a diversity of identities, experiences, and wants among people with disabilities. Many would welcome the chance to work if accommodations were provided.

“We have encouraged employers to not just ‘return to normal.’ Because what is ‘normal’? For people with disabilities, and for so many other employees, normal was not enough and it was not working.”

Maria Town, President and CEO of the American Association of People With Disabilities.

I would, however, caution against drawing too many conclusions from this data point. As I mentioned before, there is a diversity of experiences among people with disabilities, and this is not captured by any headline metric. The raw number of people with disabilities in the United States has also increased significantly since the start of the pandemic, and people with certain disabilities are more susceptible to COVID-19. This means that the composition of people with disabilities in America may have changed significantly over the last two years, making dissecting the data extremely difficult. There is not enough information to definitively declare that increased telework adoption has allowed more people with disabilities into the workforce.

Conclusions

Overall, the US labor market recovery continues apace—but with a long way to go until we reach pre-pandemic levels or the 85% prime-age employment rates achieved by countries like Japan or Portugal. At this point, though, much of the easy work has been done. Most workers who were furloughed have either been brought back to their jobs or were forced to look for other work. Today, stronger barriers have to be broken in order to improve the labor market.

Less than 60% of all Americans are fully vaccinated, and the pace of vaccinations has slowed down significantly. School closures, childcare issues, and family responsibilities are still keeping many out of the workforce. The bulk of missing workers are women—who bear a disproportionate amount of these responsibilities. Married couples are lagging behind singles in the recovery as childcare responsibilities weigh on them. Solving these problems will take a large amount of time and effort.

It is also increasingly clear that the labor market we will be exiting the pandemic will be extremely different to the one we entered with. The strength of the demand-side response has boosted investments in productivity and expansion while affording workers stronger wages and salaries. For the first time in a long time, wages for workers at the bottom of the income spectrum are rising faster than wages for workers at the top. It is not unreasonable to presume that as the labor market improves workers may permanently transition out of low-paying sectors like leisure and hospitality, even as pay in the sector improves. Employers may start dropping requirements for college degrees or other credentials, and even start investing in their workers’ education directly.

A stronger American labor market is on the way, and it will look very different from the labor market of 2019.

If you liked this post, you may like the post linked below. Check it out!