To Understand This Winter's Job Market, Focus on Layoffs

(Or the Lack Thereof)

The views expressed in this blog are entirely my own and do not necessarily represent the views of the Bureau of Labor Statistics or the United States Government.

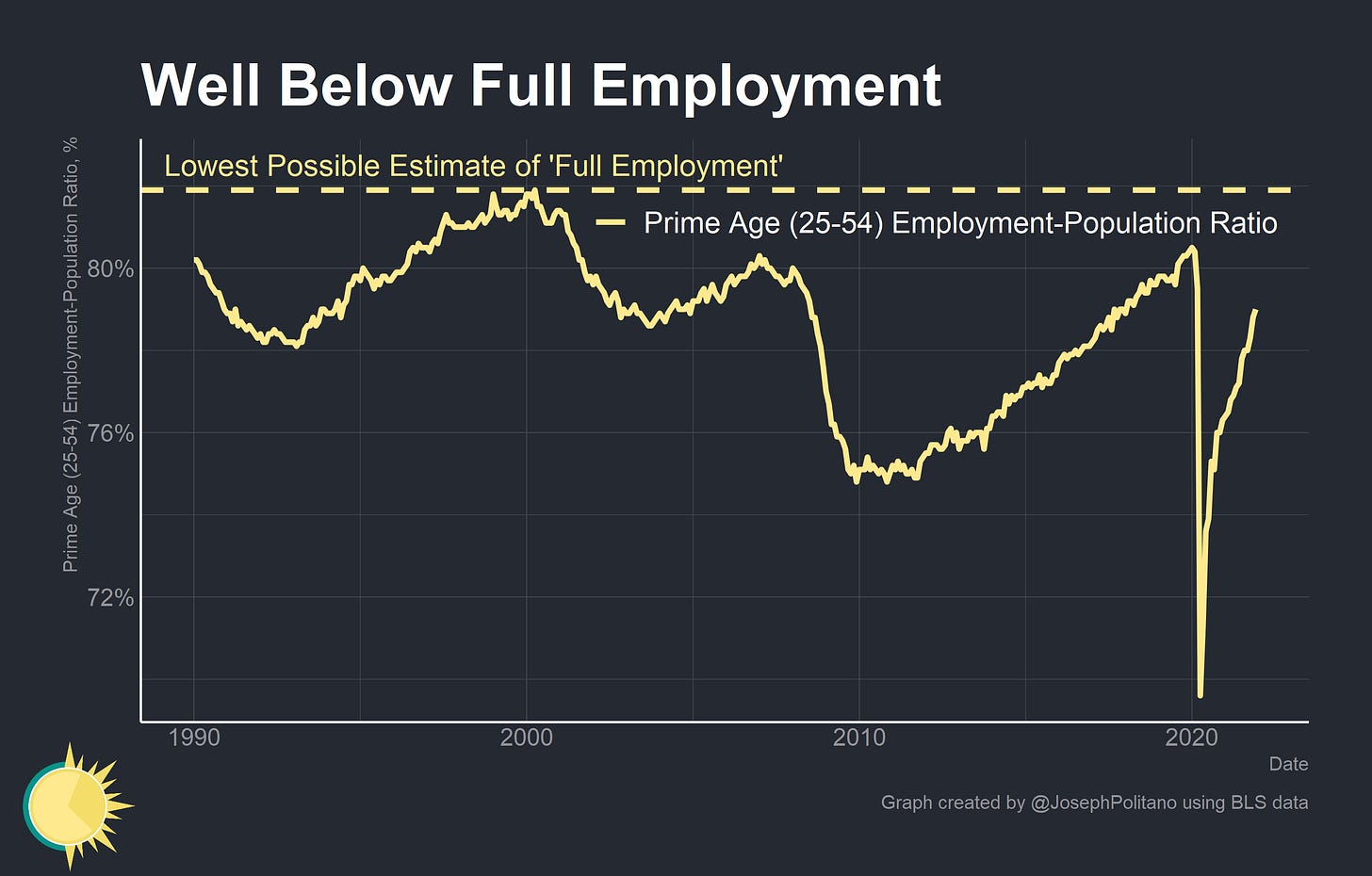

The US added 199,000 jobs and the unemployment rate declined to 3.9% this December in another month of improvement for the labor market. The Prime Age Employment-Population Ratio increased to 79%, pulling it to nearly 1% below pre-pandemic levels. The leisure and hospitality sector added 53,000 while employment in the transportation and warehousing sector increased by a whopping 19,000.

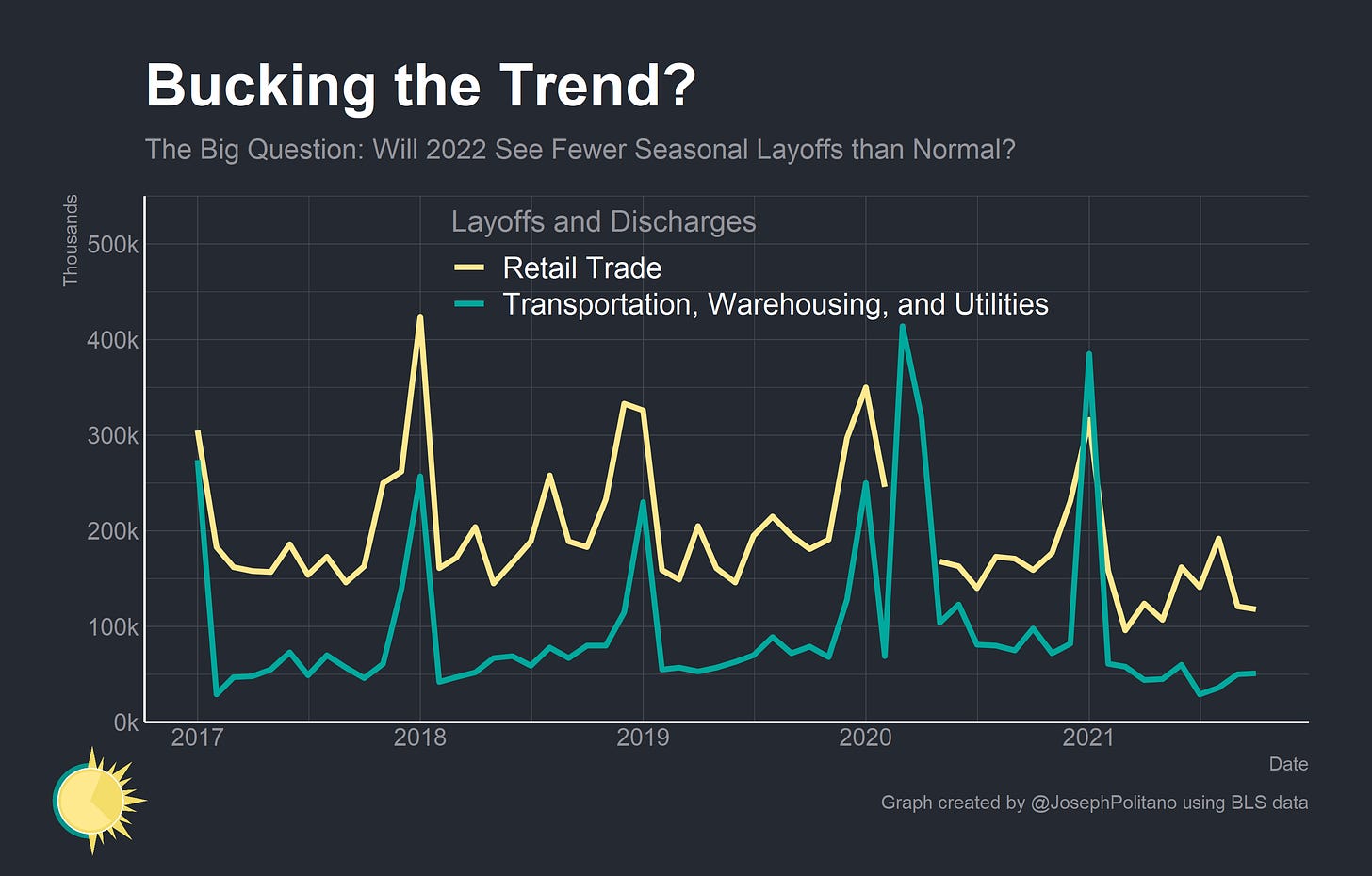

However, to understand this winter’s labor market you must focus on another labor market metric: layoffs. In normal times, firms let go of holiday seasonal workers after Christmas leading to lower non-seasonally adjusted employment levels. This is especially true in the retail trade, transportation, and warehousing sectors, where layoffs increase dramatically once holiday shopping sprees end. This year, however, the tight labor market may push firms to retain more of their seasonal workers, dampening layoffs and strengthening headline employment numbers. This trend will be critical to watch as it plays out over the coming months.

Season’s Goodbyes

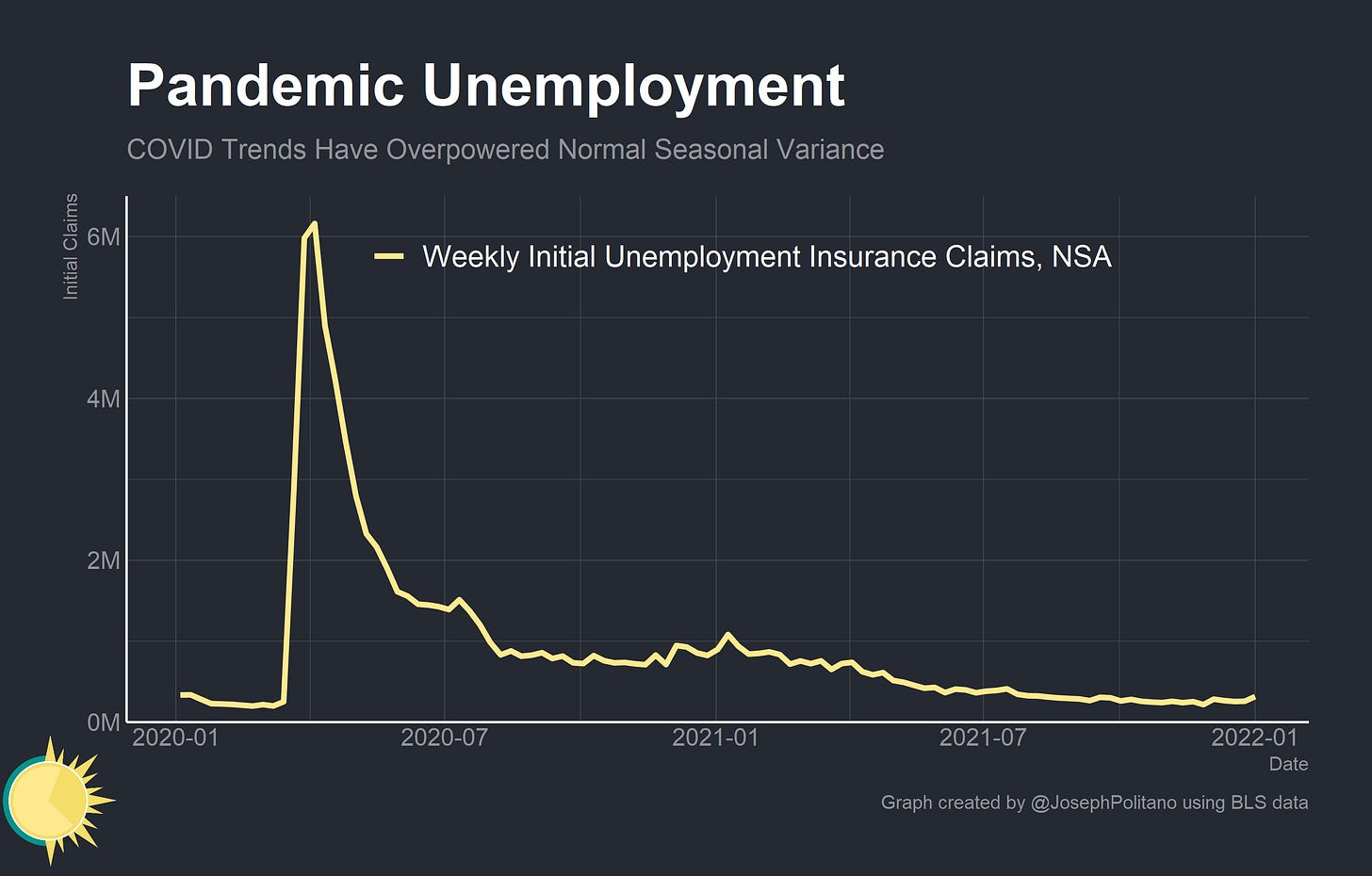

In normal years, initial unemployment claims spike dramatically after the holiday season and peak at the turn of the new year. Consumers spend a disproportionately high amount of money in December and a disproportionately low amount of money in January, leading firms to pull in temporary workers for the holiday season and let them go once the new year hits.

The retail trade and transportation/warehousing sectors are where this seasonal variation is strongest. Monthly layoffs nearly double every January in the retail trade sector and more than triple in the transportation and warehousing sector. The big question this winter is: will this pattern hold, or will firms retain more of their seasonal workers?

What makes 2022 so different? For one, extremely high labor demand is producing the strongest job market in recent memory. With hiring and wage growth both near record levels, firms are more anxious than ever about preventing worker turnover. This is especially true at the lower ends of the income scale where income growth and quits have been the highest. The result has been a drastic decline in discharges—right now total layoffs are at their lowest levels in more than 20 years. In this environment, it is not unreasonable to assume that firms will work to retain more of their seasonal staff instead of simply letting them go.

Indeed, preliminary evidence seems to indicate that seasonal layoffs may be muted this winter. Initial unemployment claims have barely ticked up in the week after Christmas, and state-level data shows initial claims in the retail trade and warehousing/transportation sectors below pre-COVID levels. Instead of laying off workers firms may simply reduce their hours while keeping them on payroll. This may prove especially true in the transportation and warehousing sector as the Omicron variant pushes people to order goods online instead of in-person. Still, it is far too early and there is far too little data to draw conclusions at this time.

If firms do hold on to more of their seasonal workers, we could be in for some extremely strong employment growth readings over the next few months. Seasonally-adjusted employment levels have been trailing non-seasonally adjusted employment levels over the last few months since the seasonal adjustment factors have discounted holiday hiring. The gap may appear small, but stands at 1.4 million total nonfarm payrolls or nearly 700,000 prime-age employees as of last month’s report. The seasonal adjustment expects job growth to be weaker, or even negative, in January, so a small bump in non-seasonally adjusted payrolls could close the gap and show up as a big increase in seasonally-adjusted payrolls. Since the headline number is seasonally adjusted, this could mean an extremely strong jobs day print next month.

Conclusions

Still, it is worth keeping in mind that there are barriers holding back employment despite the strong labor market. Childcare issues have been preventing people from returning to their jobs or remaining on the clock—especially women, who bear a disproportionate amount of childcare responsibilities. Spending has still not recovered in may service sectors, making it extremely difficult for employment to renormalize. And of course the Omicron variant has kept many workers out sick and disrupted normal school, work, and social functions. Layoffs might be the most important trend of the winter, but the most important overall trend is still the fight against COVID-19.