Trump's Retreat Still Leaves Tariffs at 90-Year Highs

China Tariffs Are Now Below "Embargo" Levels, but Overall Tariffs are at the Highest Rate Since the Great Depression

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing, you’ll join over 65,000 people who read Apricitas weekly!

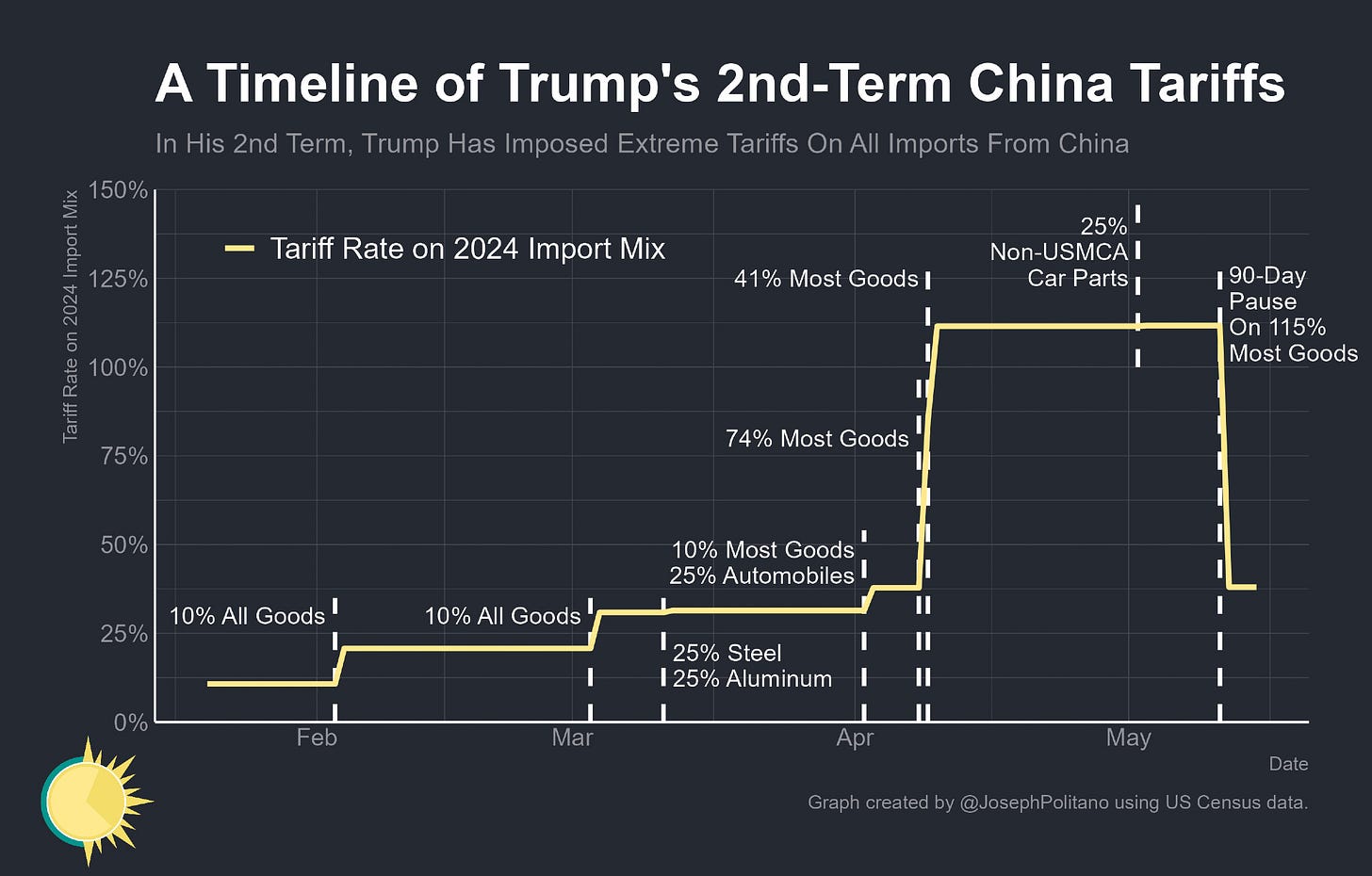

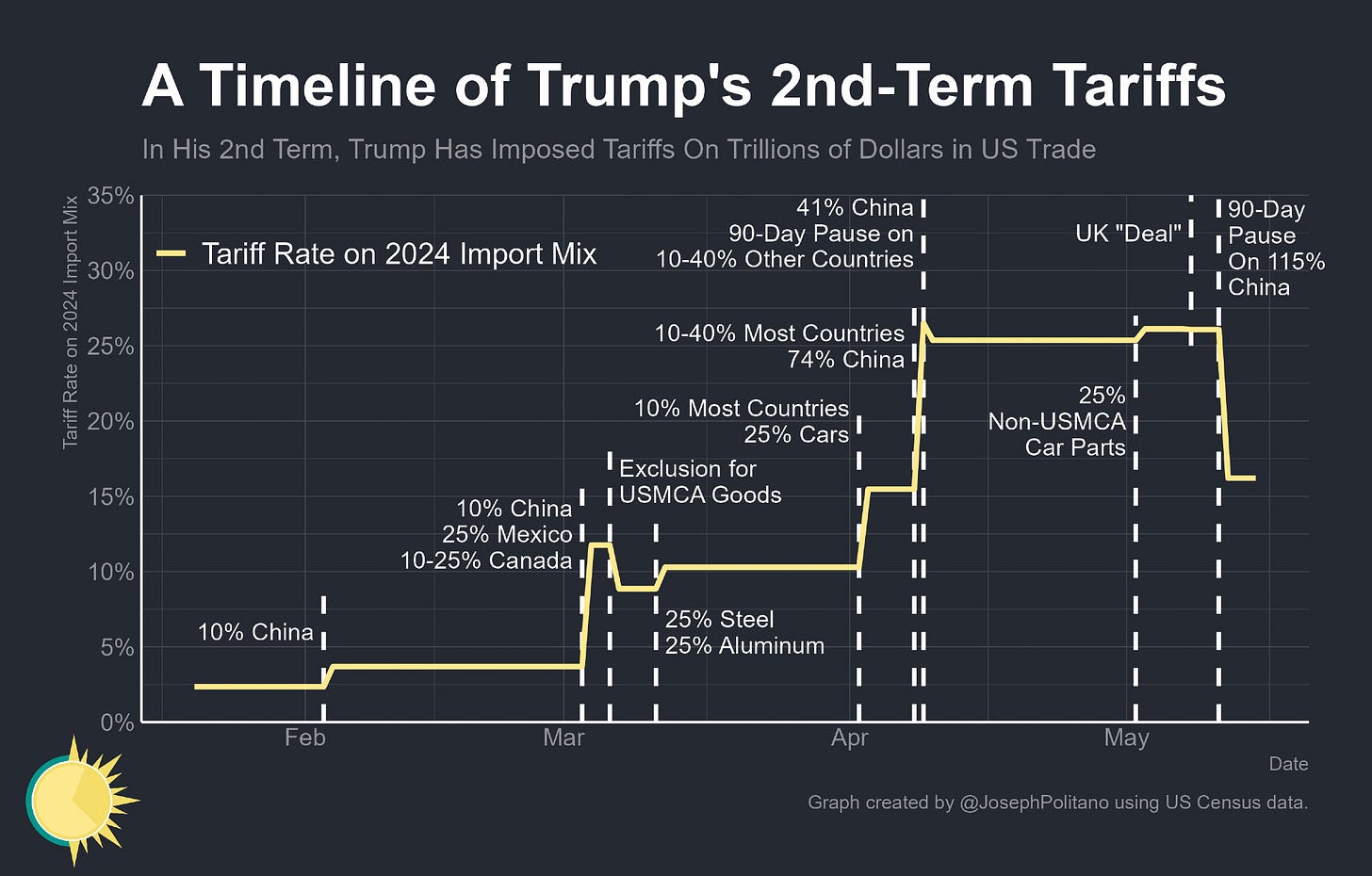

Last week, Donald Trump made the single-largest walkback of his trade war so far by agreeing to lower the tariffs on most Chinese goods by 115% as part of a 90-day “pause” for negotiations. Accounting for exceptions and sector-specific tariffs, the effective US tariff rate on China has dipped 74 percentage points, essentially bringing US policy back to the status quo of April 5th. Chinese imports now “only” face the 20% China-specific tariffs implemented in February/March, plus the 10% April 2nd tariffs imposed on nearly-all overseas imports, plus the Section 301 China tariffs that have persisted since Trump’s first term, plus sectoral tariffs on all imports of steel/aluminum/car parts/etc. In return, the US got no major concessions from the Chinese—their tariffs on US exports will come down, but remain 10% higher than pre-April, and Xi Jinping didn’t even have to symbolically lower tariffs on beef and ethanol like the UK did.

This is the largest easing of trade restrictions since Trump first began his China trade war more than seven years ago, bringing tariffs on the PRC down from “near-total embargo” levels to merely “extremely prohibitive” levels. Indeed, tariffs are now low enough to allow a significant amount of US-China trade to flow, especially given that companies will certainly take advantage of the pause by stocking up on necessary imports. Still, even after this announcement, Trump has imposed more tariffs on China than during his entire first term, which “only” saw an effective 16 percentage point increase in tariff rates compared to the 28 percentage points added through May.

In total, this still leaves overall US tariff rates roughly 8 times higher than before his Presidency, and relative US protectionism has only declined to “highest since the Great Depression” territory. That’s before accounting for the bevy of sector-specific tariffs slated to come online over the next few months, any possible unpausing of the April 2nd country-level tariffs, and any further re-escalation with China. Indeed, Treasury Secretary Scott Bessent described current China tariffs as a “floor” and the 54% tariffs announced through April 2nd as a “ceiling,” implying that tariffs on China can also only go up from here. In other words, America continues to face its worst trade shock in a generation, even if Trump’s tariff retreat significantly reduces the risk of an imminent self-inflicted recession.

The most obvious question, then, is “what was even the point of all this?”. Right now, US tariffs are mostly where they would have been if Trump’s April 2nd announcement “only” imposed his campaign promise of 10% tariffs on almost all imports. Instead, we got a week of total chaos as importers scrambled to plan around tariffs as high as 50%, followed by a month of total chaos as it looked like the administration was trying to abruptly hard-decouple from China. Millions of businesses and consumers were wrecked because they had to pay a 145% tariff that was subsequently lifted with just as little warning as it was imposed.

Bessent retroactively framed this episode as just “an unfortunate escalation”, but at every step of the process, it was the White House choosing to instigate and escalate. The “fire, aim, ready” strategy turned already-bad policy into a completely untenable disaster, and the shock-and-awe approach only served to cloak the fact that the administration still lacks coherent trade policy goals. Indeed, Trump has been completely unable to keep tariffs stationary for more than a few weeks at a time, and given his unwillingness to commit to anything but repeated “pauses”, it looks like that trend will continue over the near future. Tariffs on pharmaceuticals are supposedly slated for the next few weeks, the White House has promised to provide “revised” versions of the April 2nd tariff rates to most countries before July, and negotiations with China will likely result in even more trade restrictions between the world’s two largest economies. Trump is far from done trying to wreck America’s position in the international trade system.

What Scared Scott Bessent

If the US chose to rush headlong into this trade war with 145% tariffs on China, what pushed them to retreat so quickly? Core to the underlying rationale behind the trade war was the theory that China is so export-dependent and currently has such weak consumer demand that they, not Americans, would have to bare most of the costs of US tariffs. The US is by far the largest consumer market in the world and a massive net importer—the administration thus believed American tariffs would force Chinese manufacturers to lower their prices to maintain market access given the lack of alternative export markets of comparable size and wealth.

Yet the evidence has shown the exact opposite—Americans were bearing almost the entire price increases caused by Trump’s China tariffs. In February and March, as tariffs on all Chinese goods rose by 20%, the pre-tariff cost of Chinese imports only dipped by 0.6%. In April, when the effective tariff rate on all Chinese goods rose by an effective 74%, pre-tariff prices only fell by 0.1%. In other words, Americans were paying nearly double for Chinese imports on average—and in key sectors like chemicals, furniture, plastics, and more, they were absorbing a full 145% increase. Chinese exporters were barely lowering their prices at all to “accommodate” Trump’s tariffs.

The other scary data point was on trade volumes themselves, which were shrinking dramatically in response to the tariffs. In April, Chinese exports to the US dropped more than 20% compared to the same time last year, even as overall Chinese exports continued to grow rapidly. Without some form of tariff reduction, businesses and consumers would’ve faced acute shortages in just a couple of months.

Where the China Pause Leaves Us

Indeed, for nearly $200B worth of goods, China represents more than 70% of US imports, meaning hundreds of items would be practically unobtainable for Americans if 145% tariffs persisted. Key products like smartphones and computers had been previously exempted from those ultra-high tariffs after lobbying from firms like Apple & NVIDIA, but many goods like batteries, game consoles, microphones, and more still faced 145% tariff rates. The 90-day pause brings effective tariffs down precipitously for those key products where the US is most dependent on Chinese imports, such as toys, plastic housewares, electric heaters, and much more.

Still, overall tariffs remain extremely high for many US imports. Cars face a 19% effective tariff, pickup/delivery trucks a 10% tariff, vehicle parts a 10% tariff, and rubber tires an 18% tariff from the various motor vehicle tariffs imposed by the Trump administration. Batteries, toys, phones, computers, and other goods commonly imported from China still face heavy tariffs of up to 30%. Plus, there are still the 25% tariffs for steel & aluminum imports and the 10% baseline tariff on all overseas imports.

Broken down by country, Mexico and Canada are the major trade partners currently facing the lowest increase in US tariffs, since most of their goods are tariff-free under an exemption for exports compliant with the USMCA trade deal. That arrangement was announced as just a one-month pause back in March, but the Trump administration has still not removed the exemption a full two-and-a-half months later, and has functionally stopped talking about the issue. Meanwhile, the only countries facing similarly low tariffs are African, Middle Eastern, and South American countries who mainly export raw minerals exempt from the April 2nd tariffs. The bulk of countries instead face new tariffs near the 10% baseline level, but key trading partners like Germany, Japan, & South Korea face even higher tariffs given their large amount of car exports. Then, of course, China still faces the highest effective tariff increase of any nation by far at 28 percentage points.

Conclusions

The 90-day pause is perhaps further attempts to negotiate a “soft-decoupling” between the US & China rather than a “hard-decoupling.” Originally, American officials rushed to soften tariffs by exempting major consumer goods like iPhones & laptops as well as key electronics components from tariffs, while the Chinese exempted the high-end US semiconductors and equipment used for its AI/chipmaking industries—expect more of these sector-specific tariff changes as part of negotiations. If American officials are dead-set on ending economic “reliance” on imports of “strategic necessities” from China, the next 90 days will be spent hammering out exactly which goods America will re-hit with heavy tariffs. Of course, this could have just as easily been done at any point before April 2nd, but alas.

What’s the end goal? US representatives keep reporting that they’re looking at a multi-year project to get China to an agreement modeled on the “phase one” deal from the end of Trump’s first term, essentially asking Beijing for more commitments to buy US goods in exchange for normalized trade relations. This strategy did not work last time, as China reneged on their promises rather quickly amidst the economic shock of the COVID pandemic, and the US never lowered tariffs on Chinese goods by much. It’s hard to understand how an even more slapdash version of the same strategy will achieve results this time.

It’s even harder to understand what sort of arrangement the Trump administration wants with countries that are not China. In recent days, officials have been talking less about individual country “deals” and more about regional negotiations and another possible round of unilateral changes in tariff rates. That’s a far cry from the “90 deals in 90 days” rhetoric previously coming from the administration, and is a tacit admission that the April 2nd tariff levels are not a rational baseline for policy. For the few major partners the US still wants to negotiate with, the UK “deal” at least provides some template: the vast majority of tariffs will stay, but some tariffs can be reduced in exchange for agreements to restrain exports, nebulous purchase commitments, and symbolic reductions of tariffs on US goods. Still, we’re nearly halfway to when the 90-day pause on April 2nd tariffs is up, and the only “deal” struck has been that extremely tiny one with the UK.

Any one of Trump’s current trade policies—a 30% tariff on China, a 25% tariff on cars, a 10% tariff on the European Union—on their own would have been considered the most brutal trade war in a generation. Instead, Trump has pursued all of them, combined, all at once, and in the most chaotic way possible. Even if he walked his trade war completely back to “just” the 10% baseline tariff that is apparently non-negotiable, it would leave tariff rates at the highest level since the 1940s and would make America the world’s only high-income nation with double-digit tariff rates. Trump may be easing his trade war, but he is far from ending it.

Joe - You write "Mexico and Canada are the major trade partners currently facing the lowest increase in US tariffs". The analysis by The Budget Lab shows the opposite picture: once you account for sectoral tariffs (cars, steel, aluminum), the effective tariff rates on Canada and Mexico will be higher than the average tariff rate on the rest of the world.

*Table 2. Change in Average Effective US Tariff Rate, New 2025 Policy Through May 12*

China 33.2%

Canada 17.2%

Mexico 14.7%

Rest of the World 11.0%

https://budgetlab.yale.edu/research/state-us-tariffs-may-12-2025

So much for free trade with our neighbors! 🤯

your bias is showing . . .