Financial Conditions are Worsening

As Recession Fears Mount, Financial Conditions are Rapidly Deteriorating

Thanks for reading! If you haven’t subscribed, please click the button below:

By subscribing you’ll join over 8,000 people who read Apricitas weekly!

Otherwise, liking or sharing is the best way to support my work. Thank you!

The Federal Reserve is fighting inflation and has committed to inflicting some pain on the economy in order to get price growth down. Since the start of the year, financial conditions have been tightening as Jerome Powell telegraphed and then began executing that anti-inflation crusade. Now, with price growth still stubbornly high, the Fed has intensified its efforts to tighten policy—and the result has been a significant worsening of financial conditions across the board.

Real interest rates have increased, corporate bond spreads are up, credit access is decreasing, inflation expectations are decreasing, and significant rate cuts are now priced in for 2023 and 2024 as recession fears increase.

Tighter financial conditions are both an intentional goal and necessary byproduct of efforts to pull inflation down using monetary policy. But the obvious risk is that worse financial conditions could amplify recession risk, increase the chance of a financial crisis, or hinder efforts to increase long-run economic capacity. Though financial conditions are not at their worst levels in recent history (2008, 2012, arguably 2016, and early 2020 were all worse) the pace of change is alarmingly fast, and watching out for further deterioration in financial conditions will be critical to spotting a possible recession.

Credit Crunch

The Chicago Fed’s National Financial Conditions Index—which aggregates more than 100 measures of financial health—notched a new high this week, indicating worse financial conditions than at any point between late 2011 and early 2020. The credit subindex, which measures credit availability, is also higher than at any point between late 2016 and early 2020. The pace of the tightening is also critical—the index is rising faster than at any point since 1990, excluding major financial crises.

High yield corporate bond spreads, which proxy for recession risk by measuring default risk and borrowing difficulty for the riskiest major companies, are also at their highest levels since the early pandemic and higher than at any point from mid-2016 to early 2020. These spreads are likely underestimating the size of monetary tightening—energy companies tend to be overrepresented in the high yield indices, so recent upswings in commodity prices may be counteracting the effects of tighter monetary policy.

An Inverted Curve

The Fed’s target short-term interest rate—the Federal Funds Rate—has been rising quickly since the start of this year. Futures markets project it to rise further this year to approximately 3.25% by January—and then to decline throughout 2023 and 2024. Optimistically, these future rate cuts are just real interest rates staying constant while inflation comes down. Pessimistically this is a sign of elevated recession risk—inverted yield curves are nowhere near perfect predictors of recessions, but they do indicate that investors expect rate cuts, which are rare outside of economic slowdowns.

Futures markets began pricing in significant rate cuts for 2024 almost right after the Fed began signaling tighter policy in January. It is only recently, however, that these markets began pricing in cuts for 2023—and the level of cuts has rapidly increased. Markets now expect nearly 0.5% of rate cuts in 2023 and 0.3% of rate cuts 2024 with the expected rate in 2027 being below the peak rate in early 2023.

Keeping it Real

Real interest rates have also been significantly increasing and are now all well above their pre-pandemic levels. The real yield curve continues to flatten as real rates on shorter-maturity treasuries catch up to rates on longer-maturity treasuries—possibly indicating weakening long-run growth prospects as the Fed fights inflation.

Inflation breakevens are also moving downwards as tighter policy affects growth expectations and commodity prices (especially oil) begin shrinking. Right now 5 year inflation expectations are sitting solidly in the midrange of readings in line with the Federal Reserve’s 2% target after falling more than a full percentage point from their 2022 highs. Granted, a lot of this comes from the fact that the commodity price shock that occurred after the Russian invasion of Ukraine is no longer included in inflation breakevens (which index to CPI data with a lag of about 2.5 months) and that market participants likely expect significant disinflation from shrinking energy and vehicle prices over the next couple years. Still, worsening financial conditions are definitely putting downward pressure on growth expectations—hence why 5 year, 5 year forward (i.e. the period from 2027 to 2032) inflation breakevens are dipping below target levels.

Moment of Appreciation

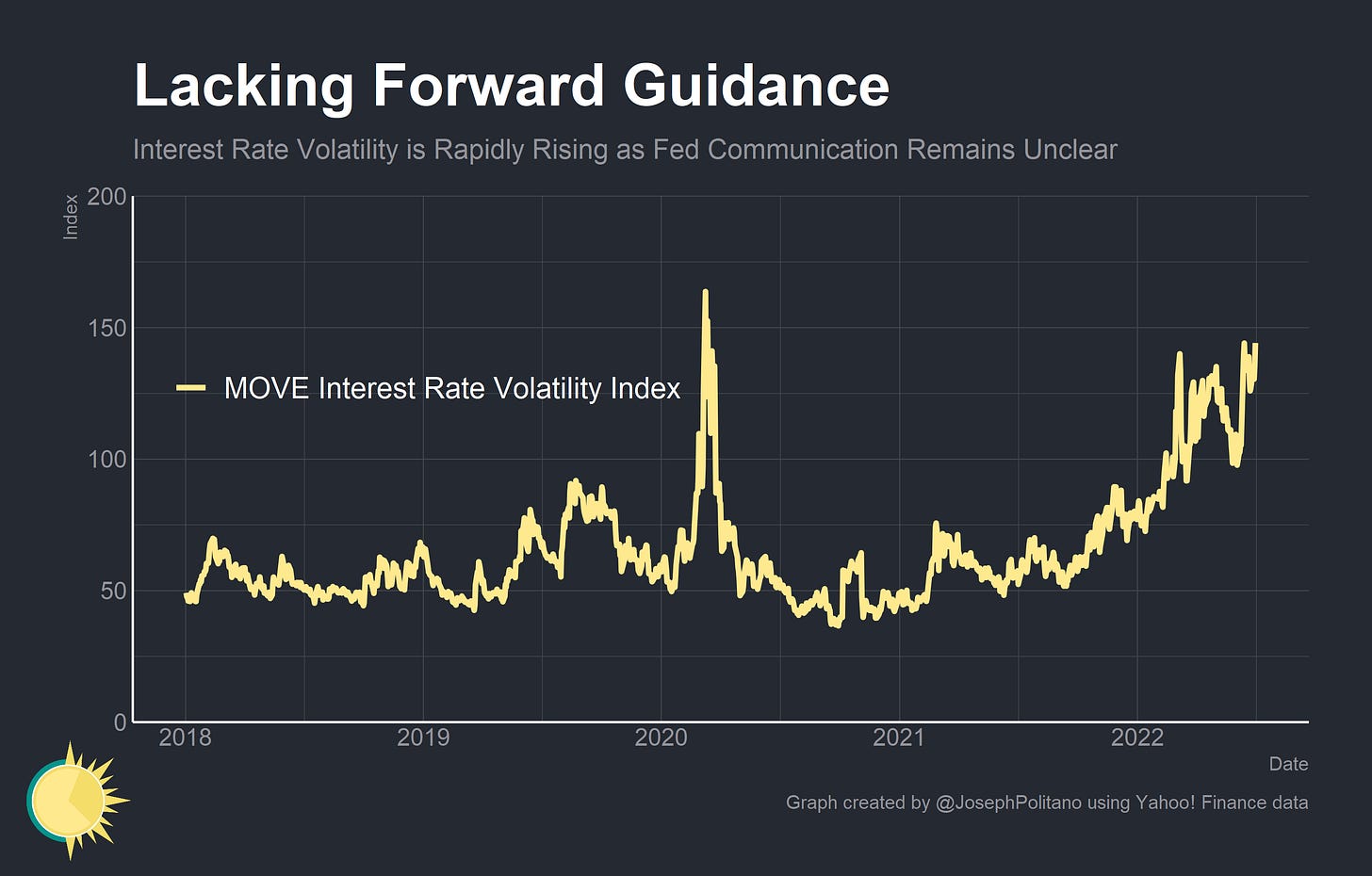

Interest rate volatility is also rising dramatically as monetary policy communication remains muddled and outcome variance increases. During intraday trading on July 5th, the MOVE rate volatility index was higher than at any point since the 2008 financial crisis.

The US dollar is also appreciating significantly as the DXY dollar index notched a nearly 20-year high earlier this week. Flight to safety, rising domestic interest rates, monetary policy tightening, and shifting terms of trade from rising energy prices are all pushing the dollar higher. Given how many foreign countries and companies borrow in US dollars, rising exchange rates could make it significantly more difficult for foreign debtors to meet their obligations and increase the risk of financial crises abroad.

Conclusions

Domestic and global macroeconomic risks are continuing to increase as the Federal Reserve works to combat inflation and financial conditions worsen. The risks of a recession in the US are increasing significantly, though it is still by no means guaranteed. Watching for further deterioration in financial conditions will be a critical part in spotting that potential recession and estimating its size—a topic I intend to write more about later this week.

Mid week joey?!

An old saying was if the USA sneezes the ROW catches a cold. Maybe it needs to be changed to have a covid reference instead but whatever things from now on will be determined by the choice of policy of central banks especially the Federal Reserve.